DKSH’s Strong Full-Year 2022 Results Confirm Successful Strategy Execution and Business Resilience

- EBIT growth of 12.2% to CHF 319.2 million• All Business Units improved performance • Free Cash Flow of CHF 209.5 million (Cash Conversion 100.6%) • Closing of ten acquisitions

- Dividend proposal ofCHF 2.15 per share (+4.9%)3

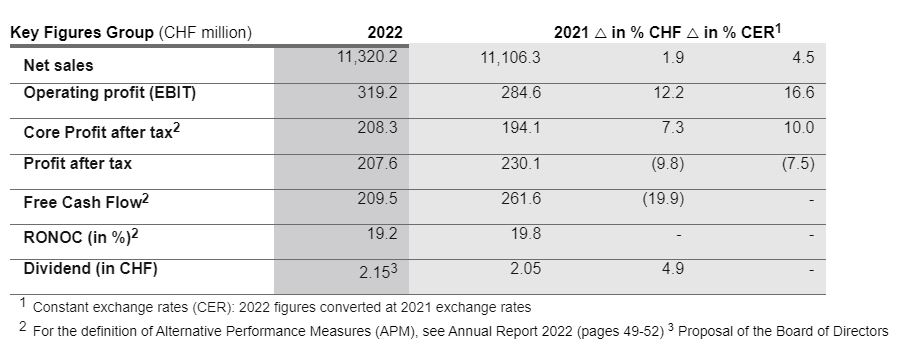

Manila, Philippines. February 22, 2023 – DKSH reported strong full-year 2022 results. EBIT increased by 12.2% (16.6% at constant exchange rates) to CHF 319.2 million, and net sales grew 1.9% (4.5% at constant exchange rates), reaching CHF 11.3 billion. The EBIT margin expanded by more than 25 basis points in an inflationary market environment. All Business Units recorded improved performance. In addition, DKSH closed ten acquisitions, grew eCommerce sales double digit, and progressed well in its Sustainability agenda.

DKSH CEO, Stefan P. Butz, said: “Our track record over the years and strong full-year 2022 results once again prove the resilience of our business model as well as the successful execution of our well-defined strategy. Throughout the last three years, which were marked by the pandemic, we increased EBIT by more than a third at constant exchange rates and improved the EBIT margin by more than 50 basis points. We remained the trusted partner for our clients and customers and continued to fulfill our purpose of enriching people’s lives.”

DKSH Group

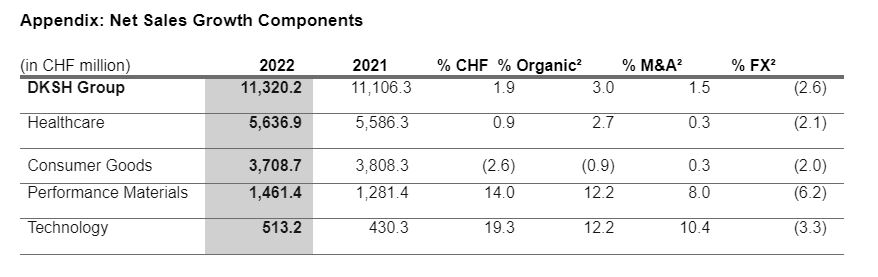

DKSH Group net sales increased by 1.9% to CHF 11.3 billion in 2022. Organic growth contributed the most with 3.0%, while acquisitions added 1.5% and exchange rates -2.6%.

EBIT reached CHF 319.2 million, 12.2% higher than 2021 and the EBIT margin increased from 2.6% to 2.8%. Profit after tax was CHF 207.6 million. Excluding one-time revaluation gains in DKSH’s Share in Associates reported in 2021, Core profit after tax grew 7.3%. Free Cash Flow reached CHF 209.5 million. The cash conversion2 improved from 68.2% in the first half of 2022 to 100.6% for the full year.

Business Unit Healthcare

Business Unit Healthcare emerged stronger from the pandemic and recorded organic growth and a double-digit EBIT increase. The EBIT margin improved from 2.3% to 2.6% with higher profitability across key segments. In addition, the Business Unit acquired businesses/trademarks in growth areas, such as Medical Devices and Own Brands. Backed by its resilient business model, the Unit will continue expanding its market position and driving into higher value segments and services.

| Healthcare (in CHF million) | 2022 | 2021 | △ in % CHF | △ in % CER1 |

| Net sales | 5,636.9 | 5,586.3 | 0.9 | 3.0 |

| Operating profit (EBIT)4 | 146.2 | 130.2 | 12.3 | 14.9 |

Business Unit Consumer Goods

The successful transformation of the Business Unit resulted in another year of EBIT growth. The Unit continued benefitting from a more agile structure, product portfolio rationalization, and value-added services. The EBIT margin increased from 2.2% to 2.3%. Net sales remained around last year’s level, as price increases to reflect inflation and lower market volumes balanced each other out. The Business Unit will continue capitalizing on its position in Asia Pacific to drive growth and profitability.

| Consumer Goods (in CHF million) | 2022 | 2021 | △ in % CHF | △ in % CER1 |

| Net sales | 3,708.7 | 3,808.3 | (2.6) | (0.6) |

| Operating profit (EBIT)4 | 86.9 | 83.3 | 4.3 | 7.2 |

Business Unit Performance Materials

Business Unit Performance Materials delivered strong net sales growth of 20.2% at constant exchange rates in 2022, supported by business development and industry demand in Europe and Asia Pacific. EBIT reached CHF 112.2 million. Considering M&A-related costs (CHF 3.6 million), translational currency effects (CHF 6.5 million), as well as realized FX and hedging gains (CHF 7.8 million), the underlying result was CHF 130.1 million. DKSH added four acquisitions in Europe, one in Asia, and a distribution platform in North America to build global reach. A scalable business model, business development pipeline, and industry consolidation potential provide future growth opportunities.

| Performance Materials (in CHF million) | 2022 | 2021 | △ in % CHF | △ in % CER1 |

| Net sales | 1,461.4 | 1,281.4 | 14.0 | 20.2 |

| Operating profit (EBIT)4 | 112.2 | 114.7 | (2.2) | 3.5 |

Business Unit Technology

Business Unit Technology achieved excellent results in 2022, exceeding pre-pandemic levels. Both net sales and EBIT increased double digit. The business benefitted from investments into Southeast Asia, its focus on key Business Lines, and from the expansion of its consumables and service portfolio. In addition, DKSH acquired DNIV Group, a distributor for the semiconductor and electronics segment in Asia. The Business Unit is determined to solidify its position in key industries in Asia Pacific, to build further resilience, and to focus on higher margin segments and services.

| Technology (in CHF million) | 2022 | 2021 | △ in % CHF | △ in % CER1 |

| Net sales | 513.2 | 430.3 | 19.3 | 22.6 |

| Operating profit (EBIT)4 | 33.2 | 20.9 | 58.9 | 63.2 |

⁴ For 2021: Expenses for the Long-Term Incentive Plan (LTIP) are partly reclassified from Other to the four Business Units. Share of profit and loss of associates are reclassified from Business Unit Consumer Goods to Other.

Outlook

Looking ahead, DKSH expects EBIT in 2023 to be higher than in 2022 based on its resilient business model, successful strategy execution, and strong balance sheet. The acquired businesses will contribute to growth in 2023. This outlook assumes economic growth in Asia Pacific, exchange rates at current levels, and barring any unforeseen events. The Group remains confident about Asia’s long-term potential and is well-positioned to benefit from favorable market, industry, and consolidation trends.

Expansion of DKSH’s Board of Directors

On March 16, 2023, DKSH will host its 90th Ordinary General Meeting in Zurich. In addition to the separate re-election of each of the current members, Gabriel Baertschi (Swiss, 1974), will be proposed as a new member of DKSH’s Board of Directors. Gabriel Baertschi is currently Chairman of the Corporate Executive Board and CEO of Grünenthal GmbH, Germany, a science-based pharmaceutical company. He has more than 20 years of international experience in the pharmaceutical industry across Asia and Europe, having held various leading regional positions within the AstraZeneca Group.

Further Information

The conference and webcast for media and investors will take place today at 11:00 a.m. CET. The Full-Year Report 2022 and recording of the webcast will be available on the DKSH website.

About DKSH

DKSH’s purpose is to enrich people’s lives. For more than 150 years, we have been delivering growth for companies in Asia and beyond across our Business Units Healthcare, Consumer Goods, Performance Materials, and Technology. As a leading Market Expansion Services provider, we offer sourcing, market insights, marketing and sales, eCommerce, distribution and logistics as well as after-sales services. DKSH is a participant of the United Nations Global Compact and adheres to its principles-based approach to responsible business. Listed on the SIX Swiss Exchange, DKSH operates in 37 markets with 32,600 specialists, generating net sales of CHF 11.3 billion in 2022. www.dksh.com

#HappeningPH #DKSH #marketexpansionservices #EBIT #earningsbeforeinterestsandtaxes #netsales #perofrmance #ecommerce #salesgrowth #sustainability #healthcare #AsiaPacific #freecashflow #businessnews #dividends #financialreport

No comments: